As a senior citizen, you have the option to choose between Medicare and Medicare Advantage Plans. Medicare Advantage Plans offer all the benefits of Original Medicare with additional coverage for dental, vision, and prescription drugs. But how do you know which plan is right for you? In this blog post, we will conduct a comparative study of compare Medicare Advantage plans and help you make an informed decision about your healthcare.

Medicare Advantage Plans

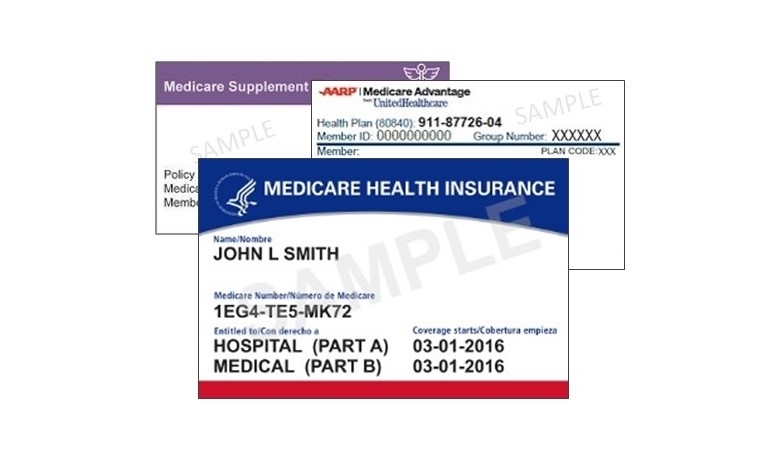

Medicare Advantage Plans, also known as Part C plans, are offered by private insurance companies that contract with Medicare. These plans provide all the benefits of Medicare Part A (hospital insurance) and Part B (medical insurance), as well as additional benefits such as dental, vision, and prescription drug coverage. Most plans also offer out-of-pocket maximums to prevent excessive healthcare costs.

Original Medicare

Original Medicare consists of two parts: Part A and Part B. Part A covers hospital expenses, while Part B covers medical expenses such as doctor visits, lab tests, and medical equipment. Original Medicare does not cover prescription drugs, dental, or vision care, and there are no out-of-pocket maximums. Many seniors choose to pair Original Medicare with a Medigap policy to cover the gaps in coverage.

Network Restrictions

One major difference between Medicare Advantage Plans and Original Medicare is network restrictions. Medicare Advantage Plans typically have a network of healthcare providers that you must use to receive coverage. Out-of-network providers may not be covered or may only be partially covered. Original Medicare, on the other hand, allows you to see any healthcare provider that accepts Medicare.

Costs

Costs are another important factor to consider when choosing between Medicare Advantage Plans and Original Medicare. Medicare Advantage Plans often have lower premiums than Original Medicare, but they may have higher out-of-pocket costs such as copays and deductibles. Original Medicare, on the other hand, has higher premiums but lower out-of-pocket costs with a Medigap policy.

Prescription Drug Coverage

Prescription drug coverage is another major difference between Medicare Advantage Plans and Original Medicare. Most Medicare Advantage Plans include prescription drug coverage, also known as Part D. Original Medicare does not cover prescription drugs, but you can enroll in a stand-alone Part D plan to get coverage.

Conclusion:

Choosing between Medicare Advantage Plans and Original Medicare can be overwhelming, but understanding the differences between these plans can help you make an informed decision about your healthcare. Medicare Advantage Plans offer additional benefits such as dental, vision, and prescription drug coverage, but they may have network restrictions and higher out-of-pocket costs. Original Medicare offers more flexibility with healthcare providers and lower out-of-pocket costs with a Medigap policy. Consider your healthcare needs and budget when deciding which plan is right for you.